employee stock option tax calculator

If youre a startup employee earning stock options its important to understand how your stock. This tax insights discusses the new employee stock option rules and answers some common questions on the topic.

A Potential Employee S Guide To Silicon Valley Startup Equity

The complete guide to employee stock option taxes.

. Abbreviated Model_Option Exercise_v1 - Pagos. For use with Non-Qualified Stock Option Plans. This permalink creates a unique url for this online calculator with your saved information.

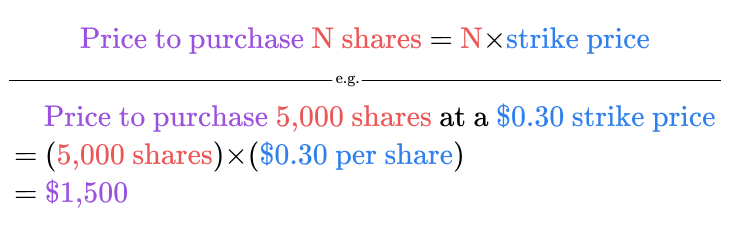

It is important to be educated on the tax implications of stock options before an option is finalized and accepted. Taxes for Non-Qualified Stock Options. Value of Shares10000 shares 3 30000.

The Stock Option Plan specifies the total number of shares in the option pool. Employee Stock Option Calculator for Startups Established Companies. The following calculator enables workers to see what their stock options are likely to be valued at for a range.

Years until option expiration date 0 to 20 Total number of options 0 to 999999 Current price per share Strike grant price per share Anticipated annual return on stock -12 to 12. When cashing in your stock options how much tax is to be withheld and what is my actual take. Emily made an Exercised Share Profit of 20000.

On this page is a non-qualified stock option or NSO calculator. Its 62 on earnings up to the taxable wage base limit. And if you earn more than 200000 you owe an additional 09 for Medicare.

Lets say you got a grant price of 20 per share but when you exercise your. This is calculated as follows. Medicare taxes have no wage base limit so youll be taxes 145 regardless of income.

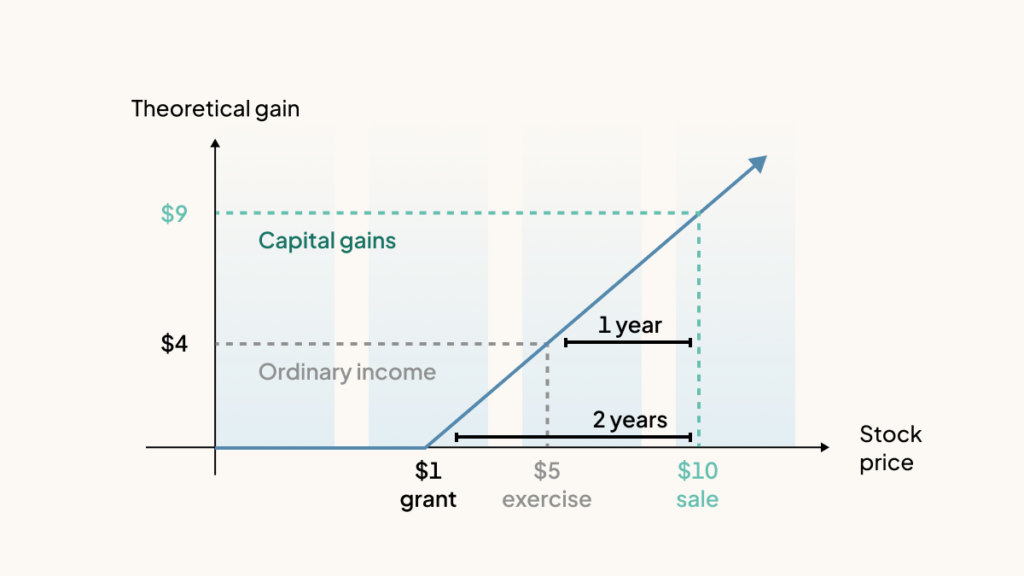

The Stock Option Plan specifies the employees or class of employees eligible to receive options. In particular the new rules limit the annual benefit on. If you sell immediately you are paying 20000 for something that is worth 60000 but youll have to pay ordinary income tax rates to lock in those gains now.

How much are your stock options worth. Use this calculator to help determine what your employee stock options may be worth assuming a steadily increasing company value. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios.

There are two primary forms of stock options ISOs and NSOs. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Exercising your non-qualified stock options triggers a tax.

ESOs offer the options holder the right to buy a certain amount of. Employee Stock Option - ESO. Employee Stock Option Tax Calculator.

On this page is an Incentive Stock Options or ISO calculator. This calculator illustrates the tax benefits of exercising your stock options before IPO. This free online calculator will calculate the future value of your employees stock options ESOs based on the anticipated.

Please enter your option information below to see your potential savings. An employee stock option is a form of equity compensation that is offered to employees and executives by upper management. Cost of Shares10000 shares 1 10000.

The Employee Stock Options Calculator. If youd like to estimate your taxes at exercise check out secfis stock option. An employee stock option ESO is a stock option granted to specified employees of a company.

Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. Stock Options Calculator for Employee Stock Option Valuation.

Income Tax On Futures Options And Turnover Calculation Kanakkupillai Learn India S Top Business Consulting Company

When To Exercise Your Employee Stock Options

Proposed Changes To Stock Option Benefit Rules Bdo Canada

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Options Esos A Complete Guide

Employee Stock Option Png Images Pngwing

Gmm Pfaudler Announces Esop For Key Employees The Hindu Businessline

Esop In India Definition Examples Advantages Disadvantages

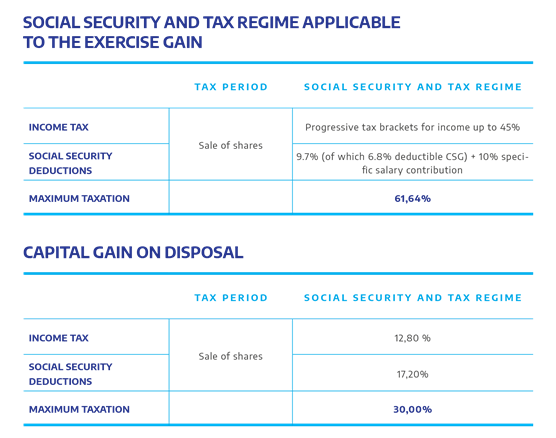

Stock Options So Welcome To France

Secfi Stock Option Tax Calculator

Tax Deductions For Employer Owned Stocks Rsus Stock Options Espps Turbotax Tax Tips Videos

How Are Stock Options Taxed Carta

Taxation Of Restricted Stock Units Rsus Carter Backer Winter Llp

Employee Stock Options Financial Edge

The Holloway Guide To Equity Compensation Holloway

Stock Options To Qualify Or Not To Qualify That Is The Question Newsletters Legal News Employee Benefits Insights Foley Lardner Llp

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Changes To Accounting For Employee Share Based Payment The Cpa Journal