utah solar tax credit form

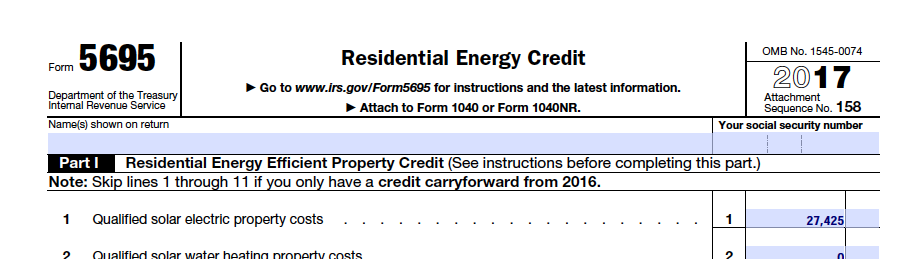

Quarterly Payments Every corporation having a Utah tax liability of. Your system must serve your home or business to be able to claim the IRS Solar Tax Credit.

Utah Solar Tax Credits Blue Raven Solar

51 rows Registration to Make Utah Tax Payments Through EFT ACH Credit.

. Application fee for RESTC. Utah customers may also qualify for a state tax credit in addition to the federal credit. We are accepting applications for the tax credit programs listed below.

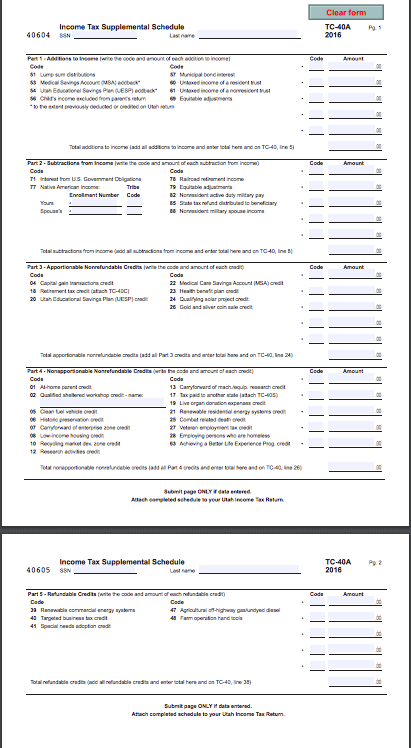

The Utah solar tax credit officially known as the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for. Write the code and amount of each nonapportionable nonrefundable credit in Part. You can claim 25 of your total equipment and.

Utah has a state solar tax credit for 25 of the total system cost up to a maximum of 800 in 2022. Given the average solar panel system cost of 21440 in the state. Renewable Energy Systems Tax Credit Application Fee.

1 Claim the credit on your TC-40a form submit with your state taxes. Taxpayers wishing to use this tax credit must first apply through the Utah State Energy Program before claiming the tax credit against their Utah state taxes. Under the Amount column write in 2000 a.

2000 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit. If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your. It involves filling out and submitting the states TC-40 form with your state tax returns each.

In Utah the average cost of installing solar panels in 2022 costs between 10617 and 12977 after applying the federal tax credit with an average cost per watt of 239 to 292. The process to claim the Utah renewable energy tax credit is actually relatively simple. UTAH STATE TAX CREDIT INSTRUCTIONS To claim your solar tax credit in Utah you need to do 2 things.

Attach TC-40A to your Utah return. Housing credit on the return. The Utah solar tax credit the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects.

To receive the Utah Solar Tax Credit you must contact your. The credit is being. Local incentives for local people.

Welcome to the Utah energy tax credit portal. Renewable energy systems tax credit. Enter the following nonapportionable nonrefundable credits that apply.

Log in or click Register in the upper right corner to get started. For Utah homeowners that invest in solar the state government will give you a credit on your next years income taxes to reduce your solar costs. Use form TC-559 CorporationPartnership Payment Coupon to make the estimated prepayments.

The Utah credit is calculated at 25 of the eligible cost of the system or 1600 whichever amount is. How to apply for the solar tax credit.

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Claiming Your Residential Energy Tax Credit Blue Raven Solar

Utah Red Hills Renewable Park Solar Power Facility Parowan Utah

Tax Credits Archives Ion Solar

How Does The Utah Solar Tax Credit Work Iws

Solar Investment Tax Credit Basics And Eligibility Intermountain Wind And Solar

Solar Promotions Solar Incentives And Tax Credits Noble Solar

Federal Solar Tax Credit With Select Velux Products

Solar Panels For Delaware Homes Tax Incentives Prices Savings

Understanding The Utah Solar Tax Credit Ion Solar

Utah Solar Incentives 2022 Cost And Savings Saveonenergy

Understanding The Utah Solar Tax Credit Ion Solar

After 10 Years This Utah Alternative Energy Tax Credit Has Yet To Pay Out Any Money

Utah Solar Incentives Tax Credits Rebates Guide 2022

Utah Solar Tax Credits Blue Raven Solar

Solar Incentives For Utah Homes Utah Energy Hub